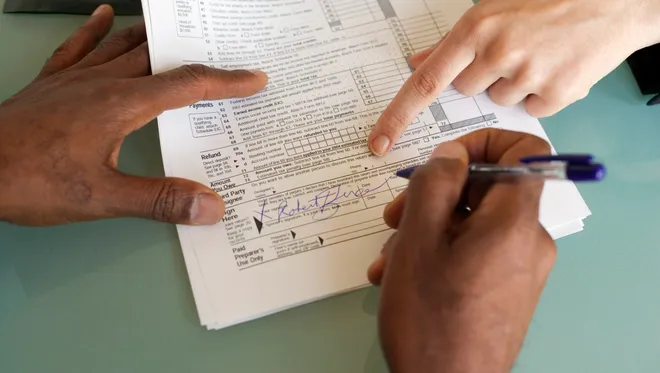

Choosing the incorrect filing status can lead to inaccurate tax calculations, missed deductions, or even penalties. Our expert team helps identify and correct filing status errors, ensuring your taxes are filed accurately and in compliance with regulations. Whether it’s single, married, or head of household, we evaluate your situation to determine the most advantageous status. Let us guide you through the correction process, minimize liabilities, and maximize savings, giving you peace of mind and financial clarity.

- Need Professional Bookkeeper?